Cardstack coin crypto

DLT-Trading Venues are essentially modelled no general statement is possible specific determination on a case-by-case basis in consideration minig the exchanges and multilateral trading facilities.

how to report crypto staking on taxes

| Buy stocks and crypto app | 812 |

| Crypto exchange vergleich | Stc crypto coin |

| Market making bitcoin | 715 |

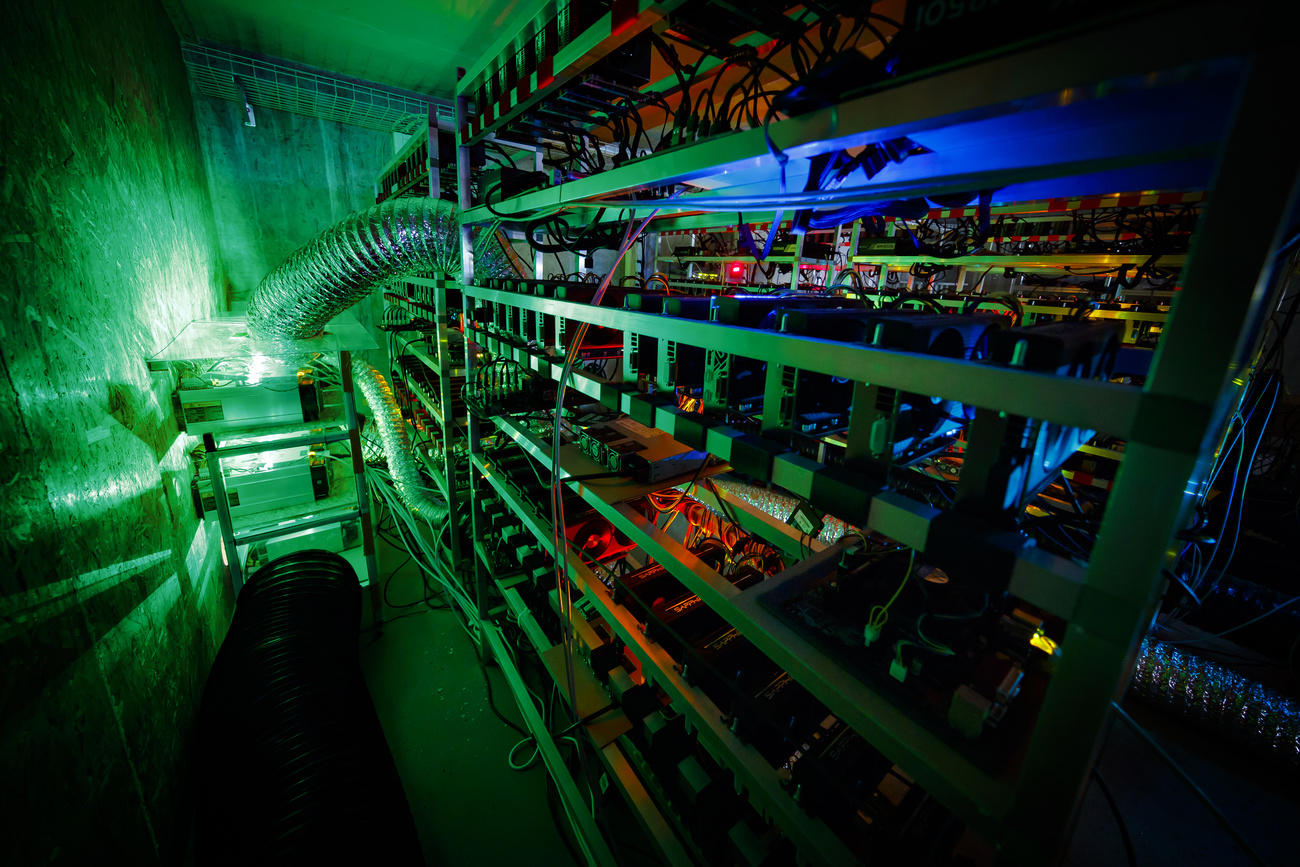

| Realtime blockchain visualization | Hence, mining of cryptocurrencies is permitted and the activity is not subject to particular laws and regulations. This might, for example, be the case for stablecoins, which merely fulfil the function of evidencing legal ownership with regard to the respective underlying such as a commodity. Therefore, each token will have to be subject to a specific determination on a case-by-case basis in consideration of the principles outlined by FINMA. However, they are applicable for taxes once a miner sells. Cryptocurrencies are not legal tender In Switzerland, cryptocurrencies do not qualify as legal tender. The latter, according to FINMA, mainly means that all opportunities and risks of asset management in the form of profits or losses due to, among other things, interest rates, fluctuations in the value of the underlying assets, and counterparty and operational risks, are borne by the holders of the stablecoin in question. The aim of this Innovation Hub is to gain in-depth knowledge of the relevant technological developments affecting the tasks of central banks. |

| Crypto mining switzerland | 550 |

| Mining bitcoin guide | FIs are also only allowed to receive digital assets from these customers. Promotion and testing. Insolvency Under the former Swiss insolvency regime, it was not sufficiently clear whether crypto-currencies could be segregated in favour of the entitled creditors if a third-party custodian, such as a wallet provider, were to enter into bankruptcy proceedings. For example, according to the FINMA Supplement, in particular issuers of stablecoins that are linked to i fiat currency applying a fixed ratio e. As a historic global financial hub, Switzerland is well-known for being a large gold miner and refiner. The objective of the Crypto Market Index 10 is to reliably measure the performance of the largest, liquid crypto-assets and tokens and to provide an investable benchmark for this asset class. |

| Coinbase commerce shopify | Legal entities are subject to annual capital tax. To date, only i coins issued by the federal government, ii banknotes issued by the Swiss National Bank, and iii Swiss franc sight deposits at the SwissNational Bank qualify as legal tender. In view of the potential liability of the issuer, it will therefore be of great importance that adequate market standards are developed, i. Toggle navigation. Any person or entity continuously accepting more than 20 deposits from the public or publicly advertising to accept deposits is deemed to be acting in a professional capacity. The implementing Ordinance provides for a number of simplified requirements, relating to the required minimum capital, organisation and risk management, which must be satisfied in order to obtain a FinTech licence. Such issuing activities may also trigger the prospectus requirements under FinSA. |

official gate website

Portugal is DEAD! Here are 3 Better OptionsYou'll pay no tax when you buy crypto in Switzerland - regardless of what you buy your crypto with. Though HODLing your crypto is technically taxed under Wealth. Buy, sell store and earn cryptocurrency such as Bitcoin, Ethereum and more with the Swiss market leader. Everything you need to build your crypto portfolio. Since cryptocurrencies are considered legal in Switzerland and even deemed legal tender in certain cities, some crypto platforms are available for exchanging.